The Bank Rate remains at 5.25% after 14 consecutive increases following a surprise drop in inflation. It’s still at its highest level for more than 15 years but borrowers will continue to see mortgage rates fall.

Key takeaways

- The Bank of England has today kept the Bank Rate at 5.25% after it was previously expected to increase it to 5.5%

- It’s thought that the Bank Rate may have peaked but is likely to remain high in an attempt to bring inflation closer to the target of 2%

- Experts were split as to whether the Bank would increase the rate as previously anticipated following a surprise drop in inflation from 6.8% in July to 6.7% in August

- Swap rates – the cost to banks of fixed-rate borrowing – have already fallen so fixed-rate mortgage rates are expected to follow

Why has the Bank of England kept the Bank Rate the same?

The Bank had been increasing the Bank Rate to get inflation under control but the latest figures showed that inflation had fallen unexpectedly.

Previous rate increases have begun to hurt the economy, with economic growth weaker than expected and unemployment rising. The Monetary Policy Committee, which decides the Bank Rate, voted by a majority of 5 to 4 to keep the Bank Rate at 5.25% today.

“Better than expected inflation figures have put an end to successive Bank Rate increases,” comments Richard Donnell, Executive Director of Research at Zoopla.

“This will be welcome news to homebuyers who have already felt the impact of mortgage rates rising higher over the summer and remaining well over 5%. This has led to demand for homes falling by 25% since the spring as buyers wait to see whether mortgage rates start to fall.”

How does the Bank Rate decision impact the housing market?

“There has been some softening in mortgage rates but as long as rates stay over 5% then house prices will continue to fall,” Richard continues.

“The concern is that money markets expect the Bank Rate to stay higher for longer in the face of higher inflation, which will keep two- and five-year fixed mortgage rates higher as well.”

“As we saw this spring, mortgage rates in the low 4% range would bring buyers back into the market. This would require money markets to expect cuts to the Bank Rate, rather than just an end to the increases.”

Housing demand and sale numbers depend on how far mortgage rates fall and the expectations of home buyers about what rate will get them back into the market. The trajectory of mortgage rates is largely down to the view of financial markets on how stubborn inflation is and how the Bank Rate is set in the future.

What will happen to mortgage rates?

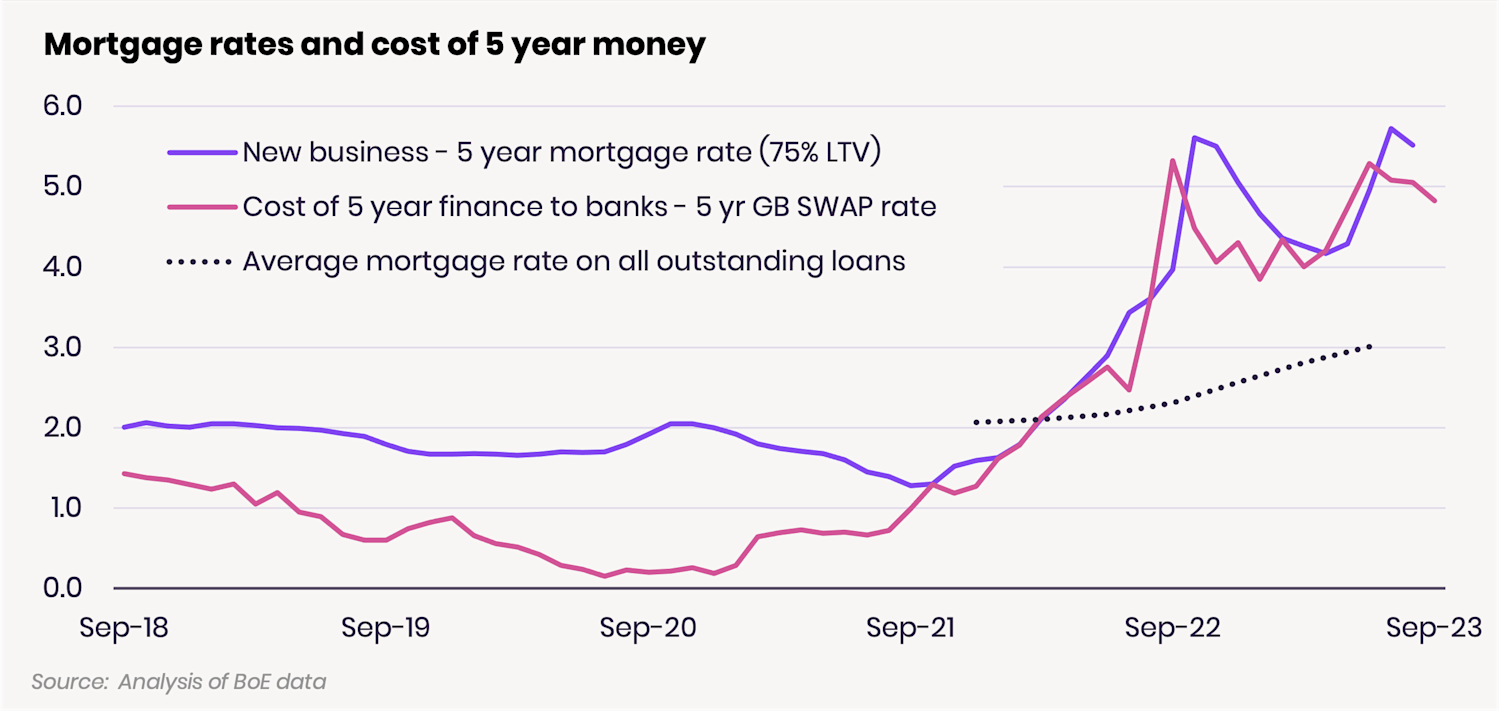

The chart below compares the mortgage rate for new five-year 75% loan-to-value mortgages against the five-year swap rate – the cost of five-year fixed-rate finance to banks – and the average mortgage rate for all 9.5m outstanding mortgages.

The swap rate has fallen back below 5% so rates for new mortgages are expected to follow.

The vast majority (82%) of outstanding mortgages are fixed-rate deals according to industry body UK Finance, so most borrowers haven’t been affected by the recent rate rises.

However, 800,000 homeowners are on fixed rates that are due to end in the second half of 2023, so they are likely to face a jump in their mortgage costs at this point.

More households fixing for five years in recent times means the average mortgage rate for all outstanding loans is now 3.0%, up from its low of 2.1% at the end of 2021.

But as households remortgage onto higher rates, this average will continue to increase, putting more pressure on the household finances of existing borrowers.

“Today’s homebuyers and remortgagers are taking what they will hope is short-term pain to get a better, lower rate in two years’ time – 40% of new mortgages are being taken at the higher 2-year fixed rate,” says Richard.

“The chart also raises some questions over the margin on new mortgage business for banks. They don’t fund solely from the money markets – they also use money from savings, current accounts and other sources to get a blended cost of funds.

“Margins looked much better for banks pre-2021 and this will be supporting their profits. Banks are fully capitalised and ready and willing to lend but they can only price against the underlying cost of finance.”

When will mortgage rates fall below 5%?

“Our view is that we will get to sub-5% rates in the second half of 2023,” Richard adds.

“Demand for homes is lower since rates started to rise in June but we are still seeing new sales being agreed. It shows there are committed buyers in the market, who are benefiting from many more homes for sale than we have seen in recent years.”

Credit: Cathy Hudson, Zoopla, 21 September 2023

Vantage – Pat McCreesh